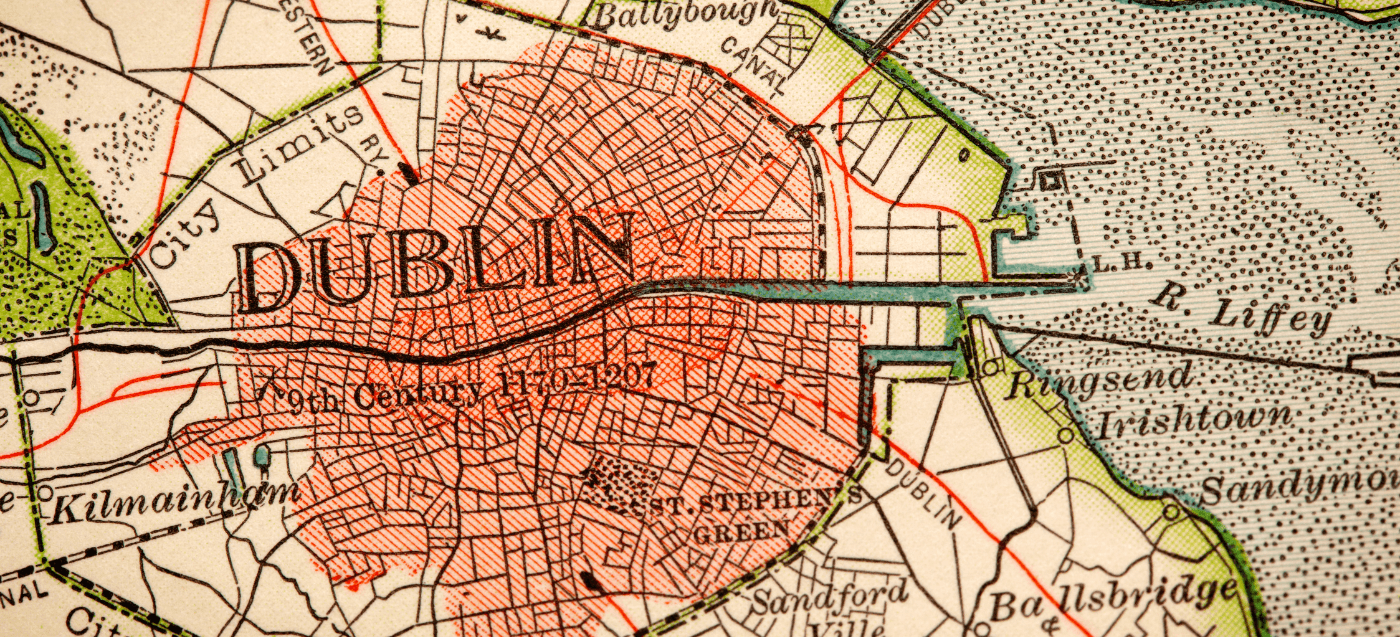

Is Ireland Your Gateway to EU Growth in 2026?

2026 is redefining EU market entry. As regulations tighten and cross-border rules evolve, Ireland is increasingly emerging as the preferred gateway for UK companies seeking stability and growth.

Advisor Spotlight: Ciaran Simpkin

FRS 102 updates 2026 introduce major changes to UK GAAP, including a new five-step revenue recognition model and updated lease accounting rules. Learn how these changes impact financial reporting and what steps companies should take to prepare for the transition.

Autumn Budget 2025

Explore the Autumn 2025 Budget changes affecting taxes, employment, pensions, and business incentives. Fiander ETL helps UK and international clients navigate planning, growth, and compliance.

Proudly Supporting the Crowning Glory Campaign

Fiander Tovell, a leading independent accountancy and advisory firm in Southampton, has announced that it will rebrand as Fiander ETL this autumn.

A New Era for Fiander ETL

Fiander Tovell, a leading independent accountancy and advisory firm in Southampton, has announced that it will rebrand as Fiander ETL this autumn.

FRS 102 Updates 2026

FRS 102 updates 2026 introduce major changes to UK GAAP, including a new five-step revenue recognition model and updated lease accounting rules. Learn how these changes impact financial reporting and what steps companies should take to prepare for the transition.

July Business Update

July Business Update - In this edition, we share some upcoming apprentice initiatives and the latest happenings within the Fiander Tovell team.

Deal Advisor Spotlight: Helen Holman

With over 20 years of experience, Helen Holman is an Associate Director working in Fiander Tovell’s Deal Advisory team. Her expertise lies in the world of corporate finance, advising business owners on business acquisitions, business disposals, valuations, restructuring and other advisory projects.

Corporate Advisor Spotlight: Adam Buse

Adam Buse leads the Corporate team at Fiander Tovell, bringing over 13 years of practice experience as a Chartered Accountant. He works across a diverse range of sectors including legal, healthcare, construction and recruitment, offering a versatile approach to client service and advice.

New Size Rules for UK Companies

The new tax year commenced on 6 April, and there are several changes to Capital Gains Tax (CGT) that have come into effect. These changes announced in the recent Autumn Budget aim to increase tax revenues and reduce the gap between CGT and income tax rates. Here’s a breakdown of what you need to know.

Private Client Tax Advisor Spotlight: Rachel Waterman

With over 25 years of experience, Rachel Waterman is a Chartered Tax Advisor who specialises in Private Client tax focusing on Inheritance Tax and succession planning, Capital Gains Tax and family trusts. Known for her dedication to providing comprehensive tax planning and advisory services, Rachel enjoys making a tangible difference in her clients’ lives and helping them to look after and protect their assets.

Capital Gains Tax Changes for the Tax Year and Beyond

The new tax year commenced on 6 April, and there are several changes to Capital Gains Tax (CGT) that have come into effect. These changes announced in the recent Autumn Budget aim to increase tax revenues and reduce the gap between CGT and income tax rates. Here’s a breakdown of what you need to know.